The proposed tax legislation being considered by our representatives is the biggest assault on the poor and middle class, and the biggest giveaway to the wealthy our country has ever entertained.

Today, we will focus on how this legislation is bad for almost everyone.

First, the GOP’s plan phases out the Estate Tax, something that only affects about 5,000 people per year who are passing on an estate of more than $5.49 million. This will cost taxpayers $172 BILLION over the next decade.

Second, the GOP plan would cause far fewer homeowners to take the mortgage interest deduction. By tampering with the standard deduction and state and local tax deduction (SALT), the percentage of Americans eligible for the mortgage interest deduction would fall from 23.3% to just 7%.

Third, “The House tax bill… preserves the carried interest tax break — paid to private-equity managers, venture capitalists, hedge fund managers and certain real estate investors — despite President Donald Trump and GOP leaders’ promise to do away with loopholes for the wealthy.”

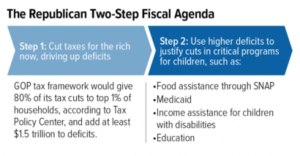

This monstrosity will add at least $1.5 TRILLION to the debt over the next ten years, which will trigger a fiscal crisis that Republicans will use to demand massive cuts to the social safety net: Medicare, Medicaid, and Social Security, as well as SNAP, housing assistance, and their favorite boogey man: the Affordable Care Act.

What could we do with this money instead?

Republican donors are demanding these tax proposals. We can stop them.

Call your Members of Congress and demand that they vote NO on any tax bill that seeks to give breaks to corporations and the wealthy at the expense of average Americans.

- Call Mike Turner at 202-225-6465

- Call Rob Portman at 202-224-3353

- Call Sherrod Brown at 202-224-2315

Script: “Hi, my name is [NAME] and I’m calling from [ADDRESS]. I am calling today to demand that [NAME] vote NO on the GOP proposed tax plan. The audacity of retaining loopholes for hedge fund managers while cutting the credits and deductions that average Americans rely on is truly alarming. I demand that my representatives in government work on behalf of their constituents, not their donors. It is obvious that the provisions in this tax plan cater to corporate interests, not those of the constituents in Dayton who are struggling to make ends meet. I will be watching this vote closely.”